How to start a non profit dance company

How to Make My Dance School a Nonprofit | Small Business

By Jordan Meyers

As a non-profit, your dance school can qualify for exemption from income, sales and property taxes, allowing you to put more of your money towards fulfilling your mission. Likewise, non-profit status may qualify you for some types of government funding. Getting set up as a not-for-profit business can, however, require a good deal of work.

Perform a Needs Assessment

-

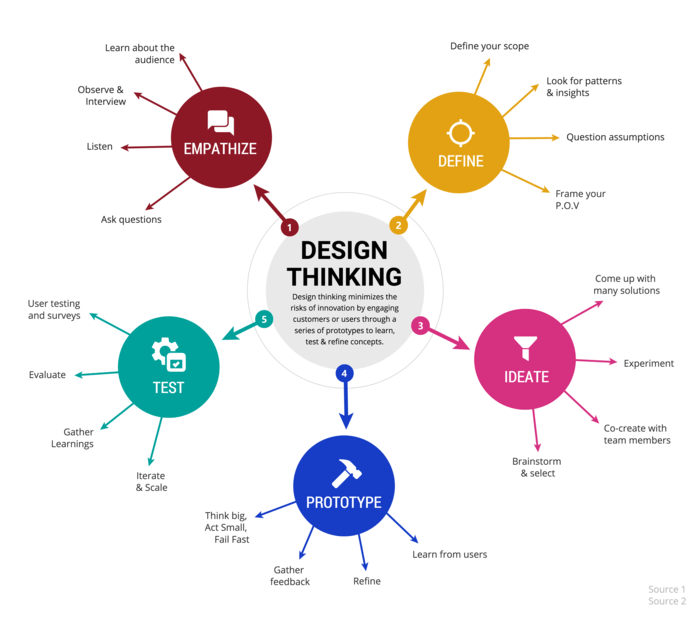

Before you start organizing your nonprofit, assess the need for a nonprofit dance school in your area. You can do this by locating other nonprofit dance schools in your area and evaluating whether they are meeting the needs of the community. If not, you might have a good basis for starting a nonprofit dance school. In addition, you can conduct research polls to determine whether your target audience has an interest in dance instruction. For instance, you can conduct surveys of low-income residents to learn whether they would sign their children up for ballet classes.

Business Plan and Mission Statement

-

You will need a business plan to start a nonprofit business. The plan should lay out how and where you will run the business, how you will market it and how you will get the money required to keep the business afloat. This plan should also explain the need for the dance instruction you will provide and describe the people you will serve. You will also need a mission statement that clearly defines your dance school's mission in a compelling manner. For example, your mission statement may include your intention to promote health and flexibility in senior citizens through dance classes. Another possible mission could involve providing dance lessons to low-income children.

Organization

-

You will need a board of directors for your nonprofit dance school. Each state has a specific number of required board members, but three is a common number. Your board members should be trustworthy and capable of bringing something to the nonprofit, such as an interest in dance, talent for organization, fund-raising and program development.

After selecting your board of directors, file articles of incorporation to make the dance school a separate entity from you and then create bylaws to stipulate how your organization will run.

After selecting your board of directors, file articles of incorporation to make the dance school a separate entity from you and then create bylaws to stipulate how your organization will run.

501(c)(3) Status

-

File for nonprofit status, also called 501(c)(3) status, with the Internal Revenue Service. Download and complete IRS Form 1023 Application for Recognition of Exemption. You can find instructions for the form in IRS publication 557. Consisting of more than 20 pages, this form is lengthy and includes many complicated terms and questions. For example, you will have to provide the name of your dance school, details about your business organization and a description of your dance school's operations in the past and present. You also will have to provide financial data for your dance school, information about any compensation your board of directors will receive and details about your plans for fund-raising efforts. For instance, if you will solicit donations by phone for dance wear, you will have to reveal this on IRS Form 1023.

You might benefit from seeking a lawyer's help with completing this form.

You might benefit from seeking a lawyer's help with completing this form.

Tax Exemption and Mailing Permits

-

As a nonprofit organization, you might qualify for state and local tax exemptions in addition to federal exemptions. For example, your nonprofit status might translate into exemption from income and sales taxes. Some states and localities will grant exemption based on your federal nonprofit status alone while others will require you to complete an application process. You can contact your state's Department of Revenue and your city or county's tax agency for details about the application process. In addition, you might want a nonprofit mailing permit, which makes your dance school eligible for cheaper second- and third-class rates for bulk mail. Contact your local post office and request information Publication 417 to learn about mail permits. You might use this permit, for example, when mailing information to a large number of potential students.

References

- National Council of Nonprofits: How to Start a Nonprofit

Resources

- United States Postal Service: Publication 417 - Nonprofit Standard Mail Eligibility

- IRS: Form 1023 Application for Recognition of Exemption

- IRS: Publication 557

Writer Bio

Jordan Meyers has been a writer for 13 years, specializing in businesses, educational and health topics. Meyers holds a Bachelor of Science in biology from the University of Maryland and once survived writing 500 health product descriptions in just 24 hours.

Steps to Take to Start a Dance Company | Small Business

By Regina Anaejionu

Since you have a passion for dance, you most likely have already narrowed down the focus of your dance company to one or two dance styles. Effective planning will help you develop the concept of your dance company further by deciding what it represents and what its purpose is. After you’ve established an appropriate name for your company and carefully screened any instructors, choreographers and dancers to ensure that their passions complement those of your dance company, you are ready to begin the planning process.

Write a Business Plan

-

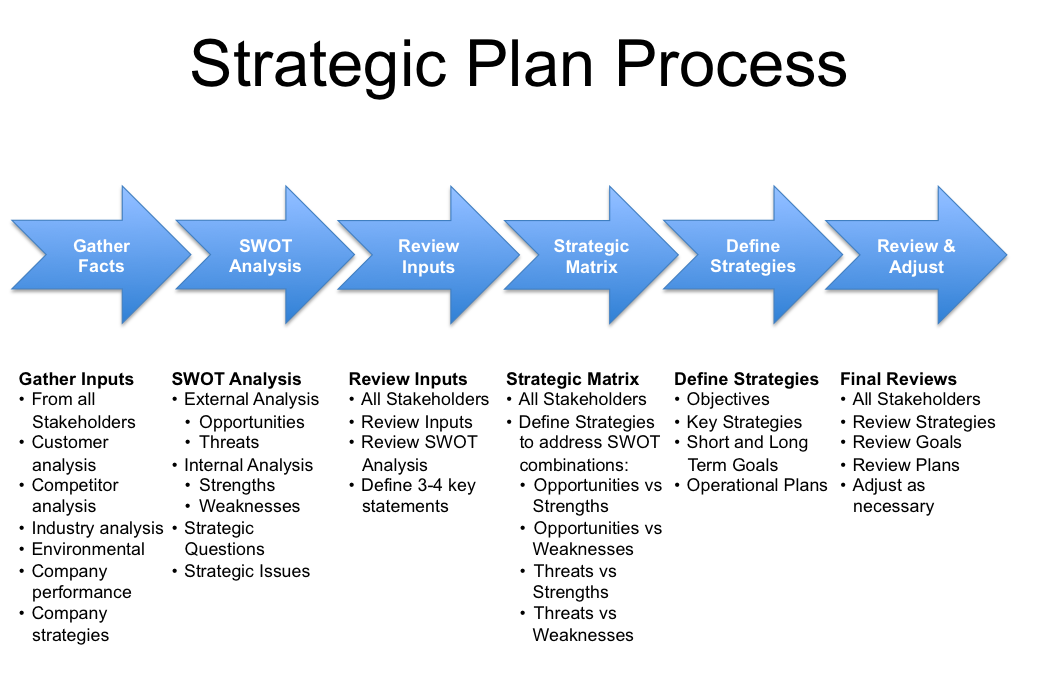

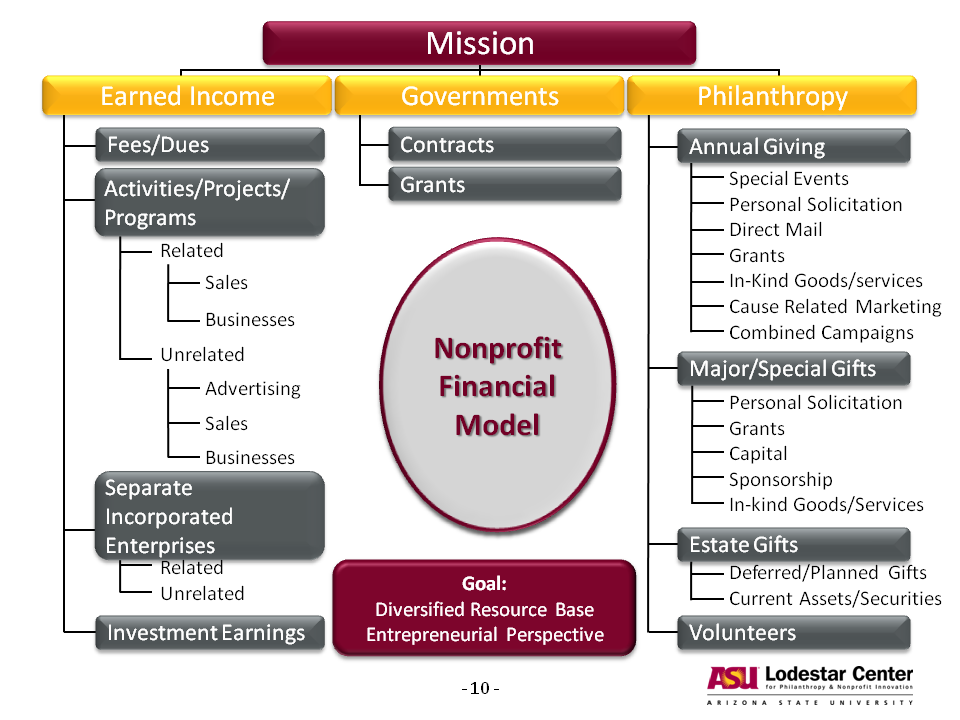

Construct a business plan that details your mission, projected financials, analysis of the market and future goals. Include your plans for obtaining funding for your company and your chosen organizational structure. Reach out to similar business owners for assistance; individuals who run dance companies in different states may be willing to help mentor you through the start-up phase. Additionally, the U.S. Small Business Administration provides many helpful resources regarding writing effective business plans.

Select the Best Business/Organization Structure

-

Determine whether you wish to be a for-profit business or a nonprofit organization. Revenues for dance companies can be low in the formative years, which may make a nonprofit business structure more attractive. You can raise funds through performances, ask for donations and perhaps even qualify for private or state grant money for your dance company.

Analyze Your Competition

-

Research other dance troupes and performance companies in your locale and surrounding areas.

Review their websites and performance schedules to understand their target market and identify any practices they employ that may help you as you form your company. Consider organizing joint performances with dance companies that offer different styles/themes so that you can pique the interest of each others' fans.

Review their websites and performance schedules to understand their target market and identify any practices they employ that may help you as you form your company. Consider organizing joint performances with dance companies that offer different styles/themes so that you can pique the interest of each others' fans.

Encourage Sustainable Growth

-

Create a budget that includes salaries for your instructors and dancers; they will be more dedicated and reliable. For start-up companies and nonprofits, it may be difficult to find funds to pay yourself or anyone else; however, loyalty will increase when you make the effort. Although the amount may not be much at first, it shows your appreciation for the long hours and physical effort they put in weekly on your behalf.

Obtain Initial Marketing Materials

-

A website is an absolute must for your dance company so that potential fans can see videos of past performances, information on your vision and mission, and a calendar of future events.

Consider investing in business cards, brochures and promotional swag that you can leave at dance studios, galleries and community venues.

Consider investing in business cards, brochures and promotional swag that you can leave at dance studios, galleries and community venues.

Launch

-

Your dance company’s launch can be one of many things. Consider organizing a fundraiser for your company, offering a free community performance, participating in a larger event such as a concert or fashion show, or hosting a charity event and donating the proceeds to the charity of your choice. When you’re first starting out, it may be necessary to perform for free in order to build a loyal following. As your reputation grows, you will be able to start charging fees.

Involve the Community

-

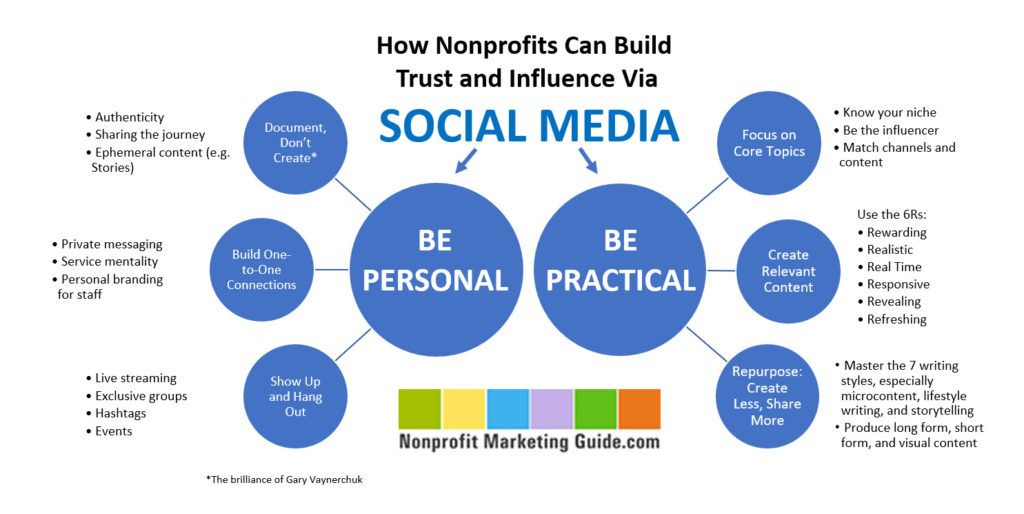

Engage your community via social media sites with pictures and videos of performances, articles on dance and company news. Poll your audience and ask them what they’d like to see you do next or what dances they enjoyed most from your last show. This helps you figure out what styles or shows are most popular.

Your dance company can adhere to the age-old economic principle of supply and demand by taking surveys to figure out demand trends.

Your dance company can adhere to the age-old economic principle of supply and demand by taking surveys to figure out demand trends.

References

- U.S. Small Business Administration: Templates for Writing a Business Plan

- U.S. Small Business Administration: Finding a Niche: Make Your Business Plan Stand Out

Resources

- "The New York Times"; First Steps and Leaps of D.I.Y. Dance Company; Julie Bloom; September 8, 2008

Writer Bio

Regina Anaejionu has a background in retail and office management. She currently owns an event planning and marketing business, and works regularly with nonprofits, artists and other businesses. Anaejionu has been writing and editing educational and fun material since 2006 and studied marketing at the University of Texas at Austin.

What is the best way to register a dance studio - as an NGO or as an individual entrepreneur?

Good afternoon!

Decided to formalize the dance group (dance studio). We settled on the form of organization - "Non-profit organization" or "Non-profit partnership".

We settled on the form of organization - "Non-profit organization" or "Non-profit partnership".

Please tell me if we made the right decision or is it better to open an individual entrepreneur? If so, what documents, besides the articles of association, need to be prepared for registration?

Thank you very much in advance for your reply. nine0003

, Marina Alexandrovna Zhirkova, Ryazan

to open an IP non-profit partnership

Svetlana Nikiforova

Lawyer, Kemerovo

Hello, Marina Alexandrov.

It all depends on the purpose for which you create a legal entity and, in accordance with what arguments, you chose this form.

Non-profits have a number of restrictions.

One of them is that, as a general rule, non-profit organizations can carry out income-generating activities, if it is provided for by their charters, only insofar as it serves the achievement of the goals for which they were created, and if it corresponds to such goals. Those. You can direct the received profit only for statutory purposes, divide it among yourself, as participants in a commercial organization can - you cannot. nine0003

Those. You can direct the received profit only for statutory purposes, divide it among yourself, as participants in a commercial organization can - you cannot. nine0003

Alexey Pogorelov

Lawyer, Kaliningrad

Good afternoon! Considering the format of activity planned by you, this format is correct, but no one obliges you to extract a large profit from the activities of the organization. Here it is worth considering what is more convenient and less resource-intensive. In this case, you can give preference to individual entrepreneurs, simple registration, minimum reporting, contributions can be turned into payment in the same amount (for example, what's the difference). Thus, it will be easier for you to live and you will be able to carry out activities calmly. In addition, if you decide to engage in commercial activities, it will also be easier. nine0003

Similar questions classes, processed everything through the bank as a loan, after signing the contract, it was necessary to terminate the loan, contacted the bank, they told me to contact where I made the purchase in order to return the money from there, but no one else got in touch nine0003

, question №3536093, Valeria, Moscow

Civil law

a refund if the contract was signed with an individual entrepreneur, and later it turned out that the individual entrepreneur had already been liquidated for 2 years, that is, now he is just an individual, and the payment was made not by an individual entrepreneur, but by transfer to a card just to a studio employee, the contract notes the fact of complete prepayment, and from the details of the IP only inn and orgnip nine0003

, question #3535985, Amina, Moscow

Licensing

Or is it all responsibility?

Good afternoon, I am opening a leisure center for children and adults. I would like to involve a psychologist. If the psychologist is an individual entrepreneur, then do you still need to check any certificates? Or is it all responsibility? I myself am an individual entrepreneur, can I conclude contracts for work with individual entrepreneurs, in particular: dance, English and chess teachers?

I would like to involve a psychologist. If the psychologist is an individual entrepreneur, then do you still need to check any certificates? Or is it all responsibility? I myself am an individual entrepreneur, can I conclude contracts for work with individual entrepreneurs, in particular: dance, English and chess teachers?

, question No. 3535752, Marina, Moscow

Protection of consumer rights

On November 7, paid for the training of a tattoo artist in the studio, the subject of the contract was the provision of paid consultations

November 7, paid for the training for a tattoo master in the studio, the subject of the contract was paid consulting services outside the framework of educational standards, one theoretical lesson was held, then no practical classes were held for two weeks due to the fact that the studio could not provide me with models for training, on November 21 wrote an application for a refund of tuition fees and refusal to study, after almost a month no refund was made, besides, they are not going to return the full cost of training, referring to the clause in the agreement on the non-refund of 50% of the cost of the entire agreement for the first trial lesson, which is initially free, but after signing the agreement turns into paid nine0003

, question No. 3535202, Amina, Moscow

3535202, Amina, Moscow

800 ₽

The issue is resolved

Medical law

Or can it be easier for her to register an individual entrepreneur?

Hello. Consultation is needed: I want to open a dental office for my wife. To do this, I plan to establish an LLC, where I will be the sole founder. Further, I plan to appoint myself the director of this LLC, and register my wife as an employee, she is a dentist with 10 years of experience. Can I be a director of this LLC? I don't have higher med. education, I have a higher technical. Or maybe it's easier for her to register an IP? nine0003

, Question No. 3534923, Evgeny, Belgorod

Inclusive Dance Laboratory of INSIDE OUT in New Holland

Calendar

Date: September 16, 2018 to September 18, 2018

9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 Sep 16, 2018 - Sep 18, 2018place

New Holland

- Public program

- External projects

- Concerts, performances and performances

as part of the cooperation of the Garazh Museum and the project "New Holland" Australian choreographer Phillip Channels, together with the Dance Integrated Australia team, will hold a three-day dance inclusive laboratory in St. Petersburg. nine0003

Petersburg. nine0003

One of the highlights of last year's "Museum of Feelings" training at Garage was a series of dance workshops organized jointly with Dance Integrated Australia. They were attended by adults with intellectual disabilities and dancers of the Ballet Moscow. As a result of this laboratory, a presentation was held by choreographer Philip Channels, where he spoke about his method of working with mixed groups.

This year dance workshops will be continued on New Holland Island in St. Petersburg. The dance will form the basis for the formation of a new vocabulary of movements, and the cinema and digital technologies that complement it will help open up perspectives for the interaction of participants with the outside world in its various physical and sensory manifestations. nine0003

The format of the laboratory has also changed: not only professional dancers and people with intellectual disabilities will be able to take part in the project, but everyone, regardless of the form of disability and dance experience. The result of the work of the laboratory will be a short video film combining two years of experience with inclusive dance practices in Moscow and St. Petersburg.

The result of the work of the laboratory will be a short video film combining two years of experience with inclusive dance practices in Moscow and St. Petersburg.

The Garage Museum of Contemporary Art would like to thank Ausdance NSW for supporting the project. nine0003

Philip Channels (born 1970, Coffs Harbour) Founder, Creative Director and Producer of dance company Dance Integrated Australia, Ambassador for Bundanon Trust Artist in Residence, former Artistic Director of Restless Dance Theater (2009-2012) ) and the first recipient of the Tomorrow Makers Award (2014).

Dance Integrated Australia is a dance company founded by Philip Channels in 2012 to prepare the conditions for the implementation of joint international projects of emerging and experienced artists, focused on involving people with different backgrounds and physical abilities in the artistic process. Guided by the principles of inclusiveness and accessibility, she challenges the audience to give them a new, unique experience. Dance Integrated Australia is an affiliate of Ausdance NSW from 2016 to 2018. nine0003

Dance Integrated Australia is an affiliate of Ausdance NSW from 2016 to 2018. nine0003

New Holland is a man-made island in the center of St. Petersburg. It was founded by Peter I in 1721 and for over 300 years was used for the needs of maritime departments, remaining closed to citizens. In 2010, Millhouse received an investment contract for the restoration of New Holland, and to create a creative concept for the island, the non-profit foundation for the development and support of contemporary culture and art "Iris" was involved. The fund was founded in 2008 by Daria Zhukova; one of his most significant initiatives is the Garage Museum of Contemporary Art in Moscow. nine0003

The result was the New Holland: Cultural Urbanization project, which aims to introduce a new approach to the reorganization and adaptation to modern functions of a single area, which is a cultural monument of federal significance. Due to the success of the temporary programs, the decision was made to abandon the original idea of developing a vacant area and organize a city park with a modern and convenient infrastructure.