How do exotic dancers file taxes

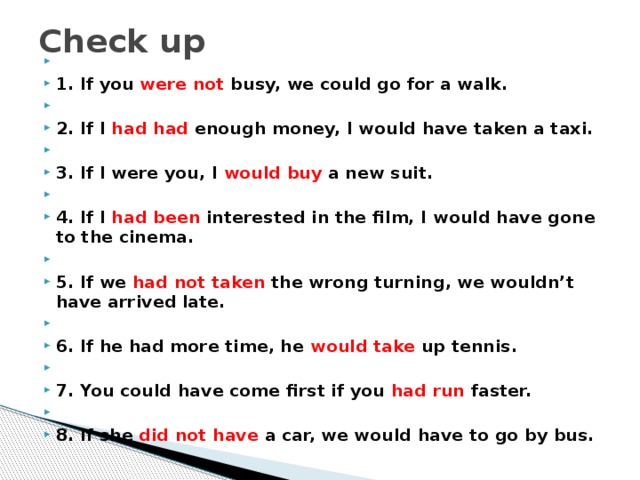

How Do Strippers Pay Taxes? Tax Preparers Offer Advice to Sex Workers

toggle

Home > Personal Finance

Source: Getty Images

On social media, inquiring minds want to know whether strippers pay taxes. And for that matter, how do strippers pay taxes?

Turns out, strippers do indeed pay Uncle Sam every year. They often report their income through Schedule C.

Article continues below advertisement

“Regardless of what you do—if you’re in business for yourself, especially—you need to follow tax laws,” Lori St. Kitts, the tax preparer behind TaxDomme.com and the author of The Tax Domme’s Guide for Sex Workers and All Other Business People, told Reuters last year.

For strippers paying taxes, Vice recommended keeping track of tips and business expenses, paying estimated taxes quarterly, and reporting income accurately to avoid tax audits.

You can use apps to keep track of tips, and don’t forget about business expenses.

On a resource page for self-employed taxpayers, the IRS advises tip-earners to keep a daily tip record, perhaps even using Form 4070 from Publication 1244.

But you can also let apps on your phone do the heavy lifting, as Vice notes. As of the time of this writing, the apps TipSee, Tip Tracker, Just the Tips, and ServerLife are available on the Apple App Store and on the Google Play Store.

Article continues below advertisement

Source: Getty Images

St. Kitts told Reuters that sex workers can deduct business expenses from their legal income, though the tax code isn’t entirely clear about which business expenses are legitimate for such workers. “But you’re pretty safe as long as it doesn’t touch the genitalia,” she added.

Article continues below advertisement

In fact, exotic dancer Cynthia “Chesty Love” Hess made headlines for getting the U.S. Tax Court to consider her breast augmentation as a tax-deductible business expense, with Special Trial Judge Joan Seitz Pate agreeing that Hess’s implants were necessary “stage props. ”

”

Use Form 1040-ES to calculate estimated tax

St. Kitts told Vice that exotic dancers can pay the IRS in installments to avoid a large tax burden come tax season.

“Putting enough aside for taxes would require paying quarterly estimated taxes,” she added. “You use Form 1040-ES to figure out your estimated tax. You can use your prior year income, credits, and deductions to figure out the amount of income you expect to make to figure out your current year estimated tax.”

Article continues below advertisement

You shouldn’t consider tip income to be “under the radar.”

Rus Garofalo, founder of the freelancer-friendly tax firm Brass Taxes, told Vice that income earned in cash might not feel like “real money” but should be treated as such when it comes to paying taxes.

“Things go from ‘under the table,’ which is a cute colloquialism, to tax evasion when it’s over 25 percent of your gross income,” he said.

As a hypothetical, Garofalo cited the example of a person who tells the IRS about only $10,000 of the $14,000 they earned in cash. “Maybe you saved a grand, but is committing a felony worth a grand?” he said.

Christopher Kirk, founder of Safeword Tax Service, told Reuters the advice he tells his sex-worker clients. He says, “The penalty for tax evasion is much greater than for sex work.”

Advertisement

Latest Personal Finance News and Updates

Advertisement

Exotic Dancers Do Their Taxes a Little Differently Than You

Strip clubs are all about indulging fantasies, from the acrobatic moves to the provocative outfits. But after a night in the club or a gig at a party, these entertainers hang up their lingerie, take off their pleaser heels, and face the same financial realities as everyone else.

This includes paying taxes on their annual income, which in the US averages around $47,000—all of which comes in the form of cash tips from their audience. Like many aspects of the adult entertainment industry, there is an air of secrecy surrounding finance and taxes, both for privacy reasons and because there’s so much variation within the profession. Some may view performing as an odd job, while others, like Bronx-based dancer Mona Marie, build whole businesses and communities from their entertainment work.

Advertisement

“In our industry, money is a touchy subject so we really don’t talk about taxes,” Marie, who owns the pole-dancing studio Poletic Justice, told me over the phone. “Every dancer is different, and every entertainer has different things going on. She may be filing taxes under her business, or filing taxes under her own brand.”

That said, there are a few somewhat consistent factors that dancers should keep in mind when preparing for tax season. Most performers are considered self-employed independent contractors, and they typically pay house fees to clubs for the opportunity to perform and earn cash tips. Some industry advocates have taken legal actions to get dancers on the official payroll at clubs, but that effort is still a work in progress, Marie told me.

Some industry advocates have taken legal actions to get dancers on the official payroll at clubs, but that effort is still a work in progress, Marie told me.

“I’m hoping that we do get a salary, or some type of hourly rate, but I find that so hard to believe,” she said. “It’s still a hustle, so it all depends.” So for the time being, dancers are primarily earning income as tips, which can be harder to keep track of than standard direct deposit or check payments that come with a salary or hourly wage.

Like any independent contractor—including babysitters, photographers, hair stylists, and comics—dancers should estimate their gross income, deductions, and credits. The IRS suggests keeping a daily log of cash tips, plus there are multiple apps that can help contractors keep up to date on their cash income, including Tip Tracker, TipSee, Just the Tips, or Tip Counter. Even easier? Contractors can calculate their income from an average week, then multiply that by 52, or however many weeks in a year they normally work.

Advertisement

Lori St. Kitts, founder of Seattle-based tax preparation business Tax Domme and author of The Tax Domme's Guide for Sex Workers and All Other Business People, told me dancers should also set up a payment schedule with the IRS, to avoid owing a large lump sum at tax time.

“Putting enough aside for taxes would require paying quarterly estimated taxes,” she said in an email. “You use Form 1040-ES to figure out your estimated tax. You can use your prior year income, credits, and deductions to figure out the amount of income you expect to make to figure out your current year estimated tax.”

In this scenario, a dancer would be filing income on schedule C of the 1040 form, which is the option for self-employed/sole proprietor. St. Kitts suggested setting up automatic payments from a savings account to the IRS in order to keep pace with taxes throughout the year.

Breast implants may be a legitimate business expense

But just as dancers should keep track for their cash income, they also need to keep a record of their expenses. That means saving receipts and records of work-related expenses, which can include outfits, transportation costs, and promotional/marketing purchases. In one interesting case, the dancer Chesty Love wrote off her breast implants, which the IRS agreed were deductible because they constituted a part of her stagecraft.

That means saving receipts and records of work-related expenses, which can include outfits, transportation costs, and promotional/marketing purchases. In one interesting case, the dancer Chesty Love wrote off her breast implants, which the IRS agreed were deductible because they constituted a part of her stagecraft.

“You’ve got to understand that as an entertainer, everything that we do is for work,” Marie told me. “Our hair, our makeup, our traveling, the clothes we wear—that’s all for work. We need to make sure that our appearance is up to date, we need to make sure that our outfit is on point, and we need to make sure that we can get to and from work, so all that ends up being jotted down.”

Advertisement

When it comes to deductions, dancers should come up with an intuitive tracking system so that they aren't left with a pile of intermixed receipts at tax time, according to Rus Garofalo, founder of Brass Taxes, a tax firm that specializes in freelance contractors.

Garofalo recommends labeling some envelopes with common deduction categories—supplies, meals, transportation, as examples—and putting them in an accessible place in your home. Whenever you have receipts from certain categories, you can drop them into the right folder and add them up once it's time to file your return.

Whenever you have receipts from certain categories, you can drop them into the right folder and add them up once it's time to file your return.

"You’re trying to encourage good behavior so put in as few barriers as possible," he said. "Don’t be under the illusion that because you care about taxes and expenses right now, you’re going to care four months from now when you spend three dollars. You need to have a workflow that’s easy for you."

Always practice safe tax practices

When you're working a job that is primarily paid in cash, it might be tempting to fudge your income, or omit it from a return entirely. "Musicians, bartenders, babysitters—these industries where they make a lot of cash, and something about it, for one reason or another, doesn’t quite feel like real money. It feels off the radar," Garofalo said.

But it's just not worth the headache of worrying about an audit. "Things go from ‘under the table’ which is a cute colloquialism to tax evasion when it’s over 25 percent of your gross income," he added. Take the example of a hypothetical person who made $14,000 in cash only claiming $10,000 on their tax return. "Maybe you saved a grand, but is committing a felony worth a grand?"

Take the example of a hypothetical person who made $14,000 in cash only claiming $10,000 on their tax return. "Maybe you saved a grand, but is committing a felony worth a grand?"

In other words, when the club audience makes it rain, be sure that some of those stacks get set aside for Tax Day.

How to pay taxes to the mobilized. Instruction - RBC

Mobilized citizens, including entrepreneurs, are not relieved of the obligation to pay taxes and file reports, the Federal Tax Service explained. RBC asked experts what to pay attention to when trusting others to do it

Photo: Andrey Lyubimov / RBC

The Federal Tax Service (FTS) gave explanations to taxpayers in connection with partial mobilization. Answers to the questions of what to do for mobilized individuals, self-employed and individual entrepreneurs (IEs) are contained in a letter from the Federal Tax Service to the territorial authorities signed by the deputy head of the service Andrey Budarin. nine0003

As follows from the explanations, conscripted citizens are not exempted from the obligation to pay taxes on time, and for entrepreneurs - insurance premiums for employees, they must also submit accounting and tax reports. However, this can be done through authorized persons by issuing a power of attorney through the commander of a military unit and sending it by mail. In the case of the payment of taxes by individuals (for example, transport tax, property tax), it can be made by relatives, friends or other third parties - according to the TIN number of the mobilized. Property taxes for 2021 must be paid by December 1st. nine0003

However, this can be done through authorized persons by issuing a power of attorney through the commander of a military unit and sending it by mail. In the case of the payment of taxes by individuals (for example, transport tax, property tax), it can be made by relatives, friends or other third parties - according to the TIN number of the mobilized. Property taxes for 2021 must be paid by December 1st. nine0003

Experts interviewed by RBC fear that it will be difficult for those mobilized in the conditions of hostilities to fulfill their tax obligations.

The Federal Tax Service accrues to individuals (not individual entrepreneurs and self-employed) only property taxes (transport, land, property tax) for self-payment. Claims come to the taxpayer's personal account or by mail. As explained by the Federal Tax Service, these taxes can be paid for by third parties, for example, relatives or friends. To do this, they need to know the TIN of the mobilized person and make a payment “for third parties”. nine0003

nine0003

At the same time, in some cases, individuals have an obligation to pay personal income tax on their own, for example, when receiving income from the sale of real estate, from winnings, remuneration. In order for the amount of tax to be calculated, the taxpayer must submit an income declaration in the form of 3-NDFL. As follows from the explanations of the Federal Tax Service, an authorized person can also submit such a declaration, but only if there is a power of attorney.

As for the self-employed, relatives can also pay taxes for them if they have a mobilized TIN. In addition, a self-employed person can set up auto-payment or authorize a credit institution to pay tax by granting it the appropriate rights in the My Tax application, the letter says. nine0003

Without a power of attorney, it will not be possible for individual entrepreneurs, as well as heads of organizations. Since they are not relieved of the obligation to file tax and accounting reports, pay insurance premiums for employees, an authorized person can carry out these actions.

The power of attorney must be notarized or equivalent. In this case, the commander of the military unit can certify the power of attorney (according to Article 185.1 of the Civil Code). It is possible to transfer a power of attorney to an authorized person, if the mobilized person did not have time to do it personally, by mail, recommends the Federal Tax Service. nine0003

Not all mobilized people will be concerned about fulfilling their tax obligations when they are called up for military service, warns Inna Ivanova, Head of Pre-trial Resolution of Tax Disputes at Lemchik, Krupsky and Partners. As a result, the Federal Tax Service may face losses due to non-payment of taxes by mobilized citizens, she believes.

Experts see another risk in the need to write powers of attorney "in the field" if the serviceman did not have time to transfer the necessary data to the authorized person. In places of hostilities, you cannot use a personal phone and there is no way to take the power of attorney to the post office yourself, so there is a risk of leakage of personal data and grounds for fraud. nine0003

nine0003

“A power of attorney must be written in such a way that there are no empty spaces for third parties to enter themselves and powers that can be abused. Authorized persons may also be dishonest. Therefore, the power of attorney should indicate limited powers that are necessary only to fulfill obligations to the state, but do not give the right, for example, to alienate property,” Ivanova advises.

It is better for taxpayers to take care of drawing up powers of attorney with a notary, access to a personal account for authorized persons and paying taxes in advance. “It is imperative to indicate the requirement for duplication of messages from the tax authorities in electronic form and on paper,” added Irina Bychkova, a leading tax practice specialist at Amulex.ru. nine0003

The government is considering giving part of the mobilized tax deferrals. Deputy Prime Minister Andrei Belousov gave the Ministry of Finance and the Federal Tax Service an instruction to ensure the possibility of postponing the deadline for paying tax and other payments, the Cabinet said on October 4. It is assumed that the measures will affect "entrepreneurs who will continue to do business." It is also planned to postpone the deadlines for the submission of declarations and reporting.

It is assumed that the measures will affect "entrepreneurs who will continue to do business." It is also planned to postpone the deadlines for the submission of declarations and reporting.

The deferment should take effect from the date of the start of partial mobilization, that is, it will apply to entrepreneurs who have already been called up, says a RBC source close to the government. nine0003

RBC sent a request about the parameters and timing of the introduction of tax holidays to the Ministry of Finance and the Federal Tax Service.

In the explanatory letter of the tax service, which was sent before the meeting with Belousov, there is no mention of delays for entrepreneurs. As for the payment of property taxes by individuals, it notes that there are no benefits for land and transport tax at the federal level, but they can be included in regional support measures. There are such cases. The government of Khakassia, for example, decided to temporarily exempt the participants in the special operation from paying transport tax, the local publication Voice of the People reported on October 3. nine0003

nine0003

At the same time, there is a general benefit for military personnel that provides for exemption from property tax for individuals, but only in relation to one object of taxation of each type (apartment or room, house, garage, etc.). Additional benefits are provided by decision of the municipalities, according to the directive of the Federal Tax Service.

Earlier, the government decided to grant credit holidays for the participants of the special operation on a declarative basis. To obtain them, you must independently apply to a credit institution, Olga Batalina, First Deputy Minister of Labor and Social Protection, explained on October 4. nine0003

In the absence of a tax deferral and indebtedness in payments, military personnel may try to exempt themselves from penalties and fines, Ivanova noted. This possibility is provided for in Art. 111 of the Tax Code on the presence of circumstances excluding guilt in committing a tax offense.

Top 10 weirdest taxes in the world

- Forbes Life

- Anastasia Novikova Author nine0052

Tax on plaster, shadow, cow farts and other objects that at first sight are not subject to taxation

Back in the 18th century, Benjamin Franklin said that nothing is inevitable in life except death and taxes. Moreover, the latter appeared long before the phrase was uttered by the famous politician. The need to collect taxes arose when the first states began to take shape. Initially, fees were levied on the ownership of land, livestock and workers. But the needs of the state grew, and with them more and more strange, and sometimes even ridiculous taxes appeared. Emperor Vespasian ordered to charge a fee in Rome for the use of public toilets, thanks to which the popular expression “money does not smell” appeared, in Byzantium there was a tax on the air, which the owners of expensive houses were obliged to pay, and in Bashkiria in the 17th century a tax on eye color was introduced . Forbes has selected ten of the strangest taxes that exist today in different countries of the world and are able to surprise, laugh and puzzle. nine0003

Emperor Vespasian ordered to charge a fee in Rome for the use of public toilets, thanks to which the popular expression “money does not smell” appeared, in Byzantium there was a tax on the air, which the owners of expensive houses were obliged to pay, and in Bashkiria in the 17th century a tax on eye color was introduced . Forbes has selected ten of the strangest taxes that exist today in different countries of the world and are able to surprise, laugh and puzzle. nine0003

Finished reading here

Foto SA CorbisGypsum tax (Austria)

Austria is one of the most popular countries in Europe for ski holidays. Skiers and snowboarders from all over the world come here every year during the season, and it was they who decided to impose an unusual tax. The availability of medical insurance for tourists seemed to the Austrian authorities not enough, so they introduced a mandatory ski tax, which was called the “gypsum tax”. Every year, about 150,000 skiers get injured while skiing and end up in local hospitals. Having calculated the total amount of their treatment, the Austrian authorities decided to charge athletes an additional tax, which is included in the cost of ski services. All funds raised by the authorities are transferred to medical institutions in Austria for the treatment of fractures and other injuries. Thus, skiers themselves "throw off" for the treatment of themselves and their fellow extreme sportsmen. nine0003

Every year, about 150,000 skiers get injured while skiing and end up in local hospitals. Having calculated the total amount of their treatment, the Austrian authorities decided to charge athletes an additional tax, which is included in the cost of ski services. All funds raised by the authorities are transferred to medical institutions in Austria for the treatment of fractures and other injuries. Thus, skiers themselves "throw off" for the treatment of themselves and their fellow extreme sportsmen. nine0003

Finished reading here

REUTERS 2013Peace Tax (Republic of Guinea)

West African countries are among the poorest in the world. But despite this, their inhabitants are still taxed, some of which can be classified as very strange. Thus, the inhabitants of the Republic of Guinea, almost the entire population of which lives below the poverty line, still pay a peace tax, although no hostilities are currently taking place in the country. Every year of peaceful life costs the citizens of the country about €17, which is a very tangible amount for the Guineans. For comparison, a kilogram of coffee in the Republic of Guinea can be bought for only 50 euro cents. A tax similar to that of Guinea has existed since the 11th century in England: the knights were required to pay special fees in those years when there were no wars in the country. The tax existed for about 300 years and then was replaced by other ways of replenishing the treasury at the expense of the troops. nine0003

Every year of peaceful life costs the citizens of the country about €17, which is a very tangible amount for the Guineans. For comparison, a kilogram of coffee in the Republic of Guinea can be bought for only 50 euro cents. A tax similar to that of Guinea has existed since the 11th century in England: the knights were required to pay special fees in those years when there were no wars in the country. The tax existed for about 300 years and then was replaced by other ways of replenishing the treasury at the expense of the troops. nine0003

Finished reading here

Fotobank Getty ImagesTax on cow farts (Estonia)

It may sound like a joke, but there is a tax on cow farts in Estonia. Moreover, it was introduced not so long ago - in 2008. In a country where there are not a large number of large enterprises polluting the atmosphere, it was decided to impose an "environmental" fee on the owners of cows. Estonian parliamentarians considered the main air pollutants to be local cows, which emit methane into the atmosphere in the course of their vital activity. Interestingly, pigs, horses and other livestock were not taxed. It is worth noting that attempts to introduce a tax similar to the Estonian one have been made before. A similar initiative was discussed in 2003 in New Zealand. An agricultural tax on the farting of famous New Zealand cows was proposed by the Labor government, but faced with protest from farmers, abandoned this idea. nine0003

Estonian parliamentarians considered the main air pollutants to be local cows, which emit methane into the atmosphere in the course of their vital activity. Interestingly, pigs, horses and other livestock were not taxed. It is worth noting that attempts to introduce a tax similar to the Estonian one have been made before. A similar initiative was discussed in 2003 in New Zealand. An agricultural tax on the farting of famous New Zealand cows was proposed by the Labor government, but faced with protest from farmers, abandoned this idea. nine0003

Finished reading here

Foto SA CorbisSun tax (Balearic Islands)

In the early 2000s, solar levy was introduced in the Balearic Islands. A tax on the sun was imposed on all tourists coming to the archipelago. Travelers arriving at the popular resorts of Ibiza, Mallorca, Menorca and other islands must pay €1 daily for staying here. The authorities use the funds raised from the sun tax to improve tourism infrastructure, such as cleaning up beaches and the coastal zone from garbage, as well as restoring the local ecological balance. It is worth noting that in 2012, 10.4 million foreign tourists visited the Balearic Islands, so the revenue from the sun tax to the treasury turned out to be very significant. nine0003

The authorities use the funds raised from the sun tax to improve tourism infrastructure, such as cleaning up beaches and the coastal zone from garbage, as well as restoring the local ecological balance. It is worth noting that in 2012, 10.4 million foreign tourists visited the Balearic Islands, so the revenue from the sun tax to the treasury turned out to be very significant. nine0003

Finished reading here

Foto SA CorbisBarbecue tax (Belgium)

In April 2007, the government of the Belgian region of Wallonia, which is home to about 4 million people, decided to fight global warming in an unusual way - and introduced a tax on barbecue. The expediency of such a collection was confirmed by environmentalists, according to which, in the process of cooking food on the grill, an average of 50 to 100 g of carbon dioxide is released into the atmosphere, which, in turn, is the cause of climate change. Walloon residents who want to barbecue in their own garden must pay a tax of €20, and this must be done every time the grill is used. It is unlikely that it will be possible to evade the payment of the fee, since the control of compliance with the tax law is carried out from the air. The territory is patrolled by helicopters equipped with thermal cameras and capable of detecting heat sources. nine0003

Walloon residents who want to barbecue in their own garden must pay a tax of €20, and this must be done every time the grill is used. It is unlikely that it will be possible to evade the payment of the fee, since the control of compliance with the tax law is carried out from the air. The territory is patrolled by helicopters equipped with thermal cameras and capable of detecting heat sources. nine0003

Finished reading here

Foto SA CorbisTax on disposable chopsticks (China)

Chopsticks are a traditional cutlery for East Asian countries. They appeared about three thousand years ago and quickly won admirers, among whom was the philosopher Confucius, who said that only they have a place on the dining table. Today in China, chopsticks are still given special preference, however, since 2006, citizens have been paying a special tax for the opportunity to use them. A fee of 5% on sales of each pair of sticks was introduced to protect forests from being cut down. Every year, about 45 billion pairs of disposable chopsticks are used and discarded in China, for which 25 million trees are destroyed. Realizing that at such a rate of deforestation in the country could disappear in the next decade, the authorities decided to tax the use of chopsticks. By the way, in addition to sticks, the Chinese government also taxed all bamboo products. nine0003

A fee of 5% on sales of each pair of sticks was introduced to protect forests from being cut down. Every year, about 45 billion pairs of disposable chopsticks are used and discarded in China, for which 25 million trees are destroyed. Realizing that at such a rate of deforestation in the country could disappear in the next decade, the authorities decided to tax the use of chopsticks. By the way, in addition to sticks, the Chinese government also taxed all bamboo products. nine0003

Finished reading here

Foto SA CorbisTax on tattoos and piercings (USA)

Residents of the US state of Arkansas should think twice before getting a tattoo or piercing. The fact is that in addition to the master’s service itself, they will also have to pay a special fee, which has already managed to get into the rating of the most unusual US taxes according to Time magazine. The piercing and tattoo tax was introduced in Arkansas in 2005, and since then, every tattoo and every piercing applied to the body requires an additional tax of 6% of their value. Perhaps the introduction of the tax was due to a campaign against tattoos that began a couple of years ago in the United States. The authorities have decided to fight unprofessional drawings on the body, because of which there is a risk of contracting dangerous diseases such as HIV, hepatitis or tuberculosis. Tax is tax, but so far the number of people who want to get a tattoo in the US is high: among Americans aged 25 to 34, one in three has a tattoo. nine0003

The piercing and tattoo tax was introduced in Arkansas in 2005, and since then, every tattoo and every piercing applied to the body requires an additional tax of 6% of their value. Perhaps the introduction of the tax was due to a campaign against tattoos that began a couple of years ago in the United States. The authorities have decided to fight unprofessional drawings on the body, because of which there is a risk of contracting dangerous diseases such as HIV, hepatitis or tuberculosis. Tax is tax, but so far the number of people who want to get a tattoo in the US is high: among Americans aged 25 to 34, one in three has a tattoo. nine0003

Finished reading here

Foto SA CorbisShadow tax (Venice)

In the early 90s, the authorities of Venice decided that it was possible to levy taxes not only on material objects, and in 1993 they introduced a shadow tax. An unusual fee was imposed on almost all owners of shops, restaurants and cafes, the shadow of whose establishments fell on municipal land. Some businessmen preferred to dismantle awnings and canopies from the facades, and those who decided to keep the appearance of their establishments unchanged annually replenish the budget of Venice with their contributions. Despite all the strangeness of the levied fee, it has not yet been canceled. In addition, the owners of Venetian cafes and restaurants have to pay a shade tax not only on sunny, but also on cloudy days, which are much more numerous in the city on the water. It is worth noting that the shadow tax is not the only intangible tax in the world. So, in the Lithuanian Klaipeda at the end of 2012 introduced a tax on rainwater. nine0003

An unusual fee was imposed on almost all owners of shops, restaurants and cafes, the shadow of whose establishments fell on municipal land. Some businessmen preferred to dismantle awnings and canopies from the facades, and those who decided to keep the appearance of their establishments unchanged annually replenish the budget of Venice with their contributions. Despite all the strangeness of the levied fee, it has not yet been canceled. In addition, the owners of Venetian cafes and restaurants have to pay a shade tax not only on sunny, but also on cloudy days, which are much more numerous in the city on the water. It is worth noting that the shadow tax is not the only intangible tax in the world. So, in the Lithuanian Klaipeda at the end of 2012 introduced a tax on rainwater. nine0003

Finished reading here

REUTERS 2013Civil marriage tax (China)

Civil marriage is not a new phenomenon. It appeared in Holland as early as the 16th century, when people belonging to different faiths could not get married in a church. Today, the number of officially concluded marriages in the world is declining, and the number of civil unions is growing. For example, in Sweden, France and other European countries, at least 60% of couples live without registering their relationship, and such statistics do not frighten the local authorities. But in China, such trends, on the contrary, are perceived as dangerous, and it was decided to fight them with the help of the yuan. Back in the middle of 90-ies in China was introduced a tax on civil marriage. The idea to charge it from all unregistered couples came to the mind of the authorities of the Chinese city of Tianjin in 1996. Since then, cohabitation without official registration of relations costs "violators" a thousand yuan a year, which is about €120. The tax is levied on those who have been reported to the local authorities as living unscheduled.

It appeared in Holland as early as the 16th century, when people belonging to different faiths could not get married in a church. Today, the number of officially concluded marriages in the world is declining, and the number of civil unions is growing. For example, in Sweden, France and other European countries, at least 60% of couples live without registering their relationship, and such statistics do not frighten the local authorities. But in China, such trends, on the contrary, are perceived as dangerous, and it was decided to fight them with the help of the yuan. Back in the middle of 90-ies in China was introduced a tax on civil marriage. The idea to charge it from all unregistered couples came to the mind of the authorities of the Chinese city of Tianjin in 1996. Since then, cohabitation without official registration of relations costs "violators" a thousand yuan a year, which is about €120. The tax is levied on those who have been reported to the local authorities as living unscheduled.

Finished reading here

Foto SA CorbisMind Expander Tax (USA) nine0069

US authorities manage to replenish the country's tax budget even with the help of illegal drugs. In 2005, the state of Tennessee introduced a tax on psychotropic substances. Marijuana, cocaine, ecstasy and other narcotic drugs were included in the list of substances that fell under the article of taxation. Traders are offered to pay the tax anonymously, and in the event of arrest, they can present evidence of its payment to the court and thereby guarantee themselves the right to indulgence. It is also worth noting that in early February 2013, US Democratic congressmen launched an initiative to decriminalize marijuana throughout the United States (now it is allowed in 40% of states). Thus, lawmakers are offering Washington to make money on hemp through the introduction of new taxes.